20% Branch Growth Just By Changing One ‘Critical’ Conversation

By Ron Buck

Branch conversations between a personal banker and customers have changed forever. In fact, over 80% of customer conversations are now service-related. Branches have become the service-hub of all delivery channels (mobile, Internet, ATM, call center and other interactive (or self-service) teller machines). With less sales-related conversations, new account growth has steadily declined over the past decade. Our research (300 banks and 10,000 branches) indicates that over 42 % of retail bank branches have negative account growth (i.e. they are closing more accounts than they are opening).

Most bank branches have 2 to 5 sales related-conversations per personal banker each day. (Credit unions vary from 5 to 12 sales-related conversations per personal banker per day). Cross-sell ratios vary from 1.0 to 1.5 with a national average across all sales-related conversations (the average of new and existing customers) of 1.18. Despite many initiatives to improve cross-sell ratios, the national average has stayed almost constant for over a decade.

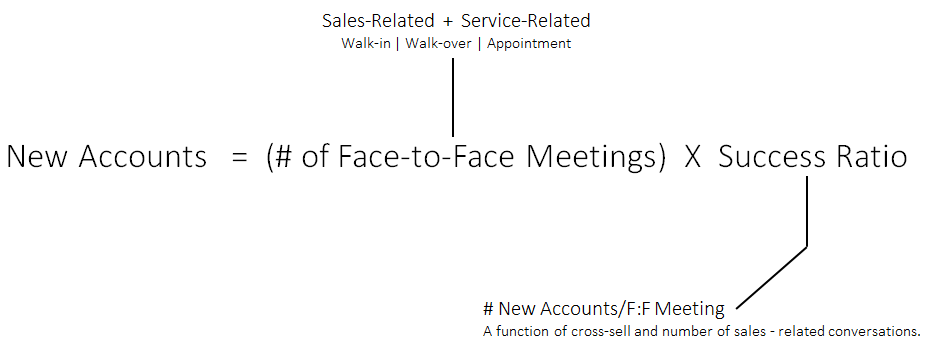

Figure 1.0 illustrates the new account relationship to face-to-face meetings and success ratio. Success ratio is the new measure of sales effectiveness in retail banking. Face-to-face meetings include both service-related and sales related. Subsequently, the success ratio is a function of both cross-selling and the percentage of sales-related conversation.

Figure 1.0

Traditionally, banks have tried to execute one or two different strategies with marginal success.

- Increase The Number of Face-to-Face Meetings. This is the most common strategy to drive new account growth using referrals and other outbound calling initiatives. If the personal bankers are currently having 5 face-to-face meetings each day (and 1 is sales-related) with a 1.2 cross-sell ratio, they are each opening 6 new accounts each week. A typical goal is to add one more new sales-related conversation per week (resulting in 7.2 new accounts opened each week). This is a good sales strategy to grow new accounts by 20% if well executed.

- Increase The Cross-Sell Ratio. This is also a very common strategy to drive new account growth. Increasing the cross-sell ratio proportionally increases the success ratio. One additional cross-sell each week will grow new accounts by 20% if well executed.

Our research indicates there is an emerging group of high performing branches that are changing the conversation and winning with one well executed strategy. These high performers have focused on cause-and-effects related to the success ratio. They have found that about 65% of service-related conversations are driven by a life-event and if they can ‘transition’ one service-related conversation to a sales conversation each week they grow new accounts by at least 20%. Here is an example:

- Transition Service-Related Conversations To Sales-Related Conversations. If each personal banker is having 5 conversations per day (1 sales-related and 4 service-related) with a 1.2 cross-sell ratio, then each personal banker is opening 6 new accounts per week. If each personal banker can ‘transition’ one service-related conversation to a sales-related conversation each week, then each personal banker opens 7.2 new accounts per week (20% growth).

Every sales strategy needs to be executed well or its objectives will not be achieved. Sales execution requires a singular focus on just one goal; acting on the lead measures influencing the goal (face-to-face meetings; cross-sell ratio; or service-to-sales conversion ratio); a compelling scorecard; and a cadence of accountability.

The highest performing branches have a single focus on ‘net’ new account growth of 20%. They have scorecards that track the service-to-sales conversion ratio on weekly, monthly, quarterly and annual intervals and have adopted a cadence of accountability.

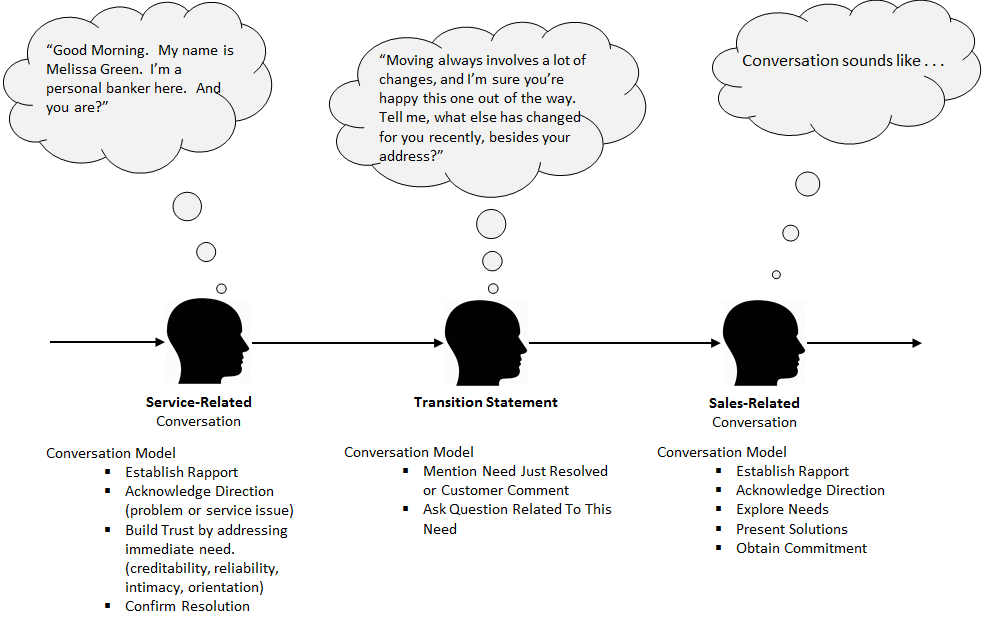

Figure 2.0 illustrates this new strategy and conversational model.

Figure 2.0

Example Customer Conversation (Service to Sales)

| Personal Banker (Melissa) | Customer (Brian Walsh) | |

| Establish Rapport | (Standing, shaking hands.) “Good morning. My name is Melissa Green; I’m a Customer Service Representative here. And you are?” | |

| “Brian Walsh.” | ||

| “Nice to meet you Mr. Walsh, please have a seat. What brings you in today?” | ||

| Acknowledge Direction | “We just moved into a new house, so I need to change the address for our accounts.” | |

| “Congratulations on your new home! I’d be happy to take care of that address change for you. May I please have your ID?” | ||

| “Sure.” | ||

| Explore Needs (Related to Service Issue) | “Is the address shown here the one for your new home? | |

| “Yes.” | ||

| “And did any of your phone numbers change?” | ||

| “No, we were able to keep those the same. Will you make the change for both of our accounts?” | ||

| Build Trust by Solving Immediate Need | “Yes, I’ve changed our records for both your checking and savings account. Let me have you review what I’ve printed here to confirm it’s correct and then please sign right here for me…” | |

| “OK, everything is correct.” | ||

| Confirm Resolution | “Thank you. Have I completely taken care of your immediate need today, Mr. Walsh?” | |

| “Yes, that was all.” | ||

| Transition to Sales Conversation & Explore Needs | “I’m happy I was able to help. Moving always involves a lot of changes, and I’m sure you’re happy to have this one out of the way. Tell me, what else has changed for you recently, besides your address?” | |

| “Well, my wife got a new job and they gave her a nice signing bonus. We were hoping to earn a better rate on that money when we put it in our savings account, so the balance would grow faster. But we can’t afford to tie it up for long, because we need it for landscaping improvements in the fall…” | ||

| “Of course. What amount will you be depositing?” | ||

| “A little over $4,000.” | ||

| Present Solutions | “Actually, you can earn more on those funds and still have them available next fall. We have a short-term CD that pays a better rate than your savings account, but would still mature before you need it in the fall. How does that sound?” | |

| “That sounds perfect! Of course I’ll have to discuss it with Denise first, but it sounds like just what we need.” | ||

| Obtain Commitment | “We are open until 6 PM on Fridays. Would you be able to come in this Friday to open the CD—assuming Denise is on board of course?” | |

| “Yes—we could come by around 5:30 after she gets home from work.” | ||

| “Great, I’ll call you Thursday night to confirm and then have everything ready for you when you come in on Friday.” | ||

| “Thanks for suggesting the CD.” | ||

| “You’re very welcome. I’ll see you Friday night. And congratulations again on your new house.” | ||

| “Thanks. Bye.” |

Transition to a Sales Conversation

- Mention need just resolved or customer comment

- Ask a question related to this need

Examples:

Service Issue: “I’m happy we were able to resolve your statement error/card failure/inappropriate charge. Our goal is to ensure your complete satisfaction. To ensure I have a good understanding of your needs and priorities, may I ask you a few questions about your banking arrangements?”

Account Change: (such as address change/change to account type/new person added to account/IRA withdrawal): “Congratulations again on your recent wedding/birth of your (grand) child/retirement. A major life event like this often impacts many aspects of your financial situation. May I ask a few questions about your current situation and make sure we’re doing all we can to support your goals?”

Request for Help: “I’m glad I was able to help you set up your online banking/balance your checkbook/order new checks. To ensure all aspects of your banking relationship are working effectively for you, may I take a few minutes to ask you a few questions?”

General: “I’m glad you stopped in today because we haven’t met in a long time. My job is to make sure you’re financially successful by finding solutions to meet your financial needs and goals. Since these needs change throughout life, I’d like to get up-to-date on where you are today. May I ask a few questions about your current situation and take notes for future reference?”

If you would like to learn more about this best practice and how you can integrate it with your existing training programs, contact:

- Ron Buck

- 480-212-6082